indiana tax payment voucher

2021 IT-40 Income Tax Form. Know when I will receive my tax refund.

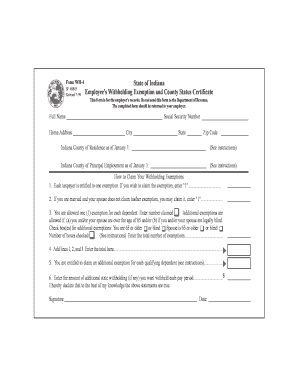

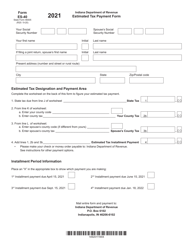

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

All payments must be made with US.

. Beneficiarys Share of Indiana Adjusted Gross Income Deductions Modifications and Credits. For the 2022 tax year estimated tax payments are due quarterly on the. To pay by credit card you may make an estimated tax payment online.

Claim a gambling loss on my Indiana return. This form is for income earned in tax year 2021 with tax returns due in April 2022. The Auditor of State is also the Administrator of the state of.

Write your Social Security number on the check or money order. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R22 12-21 Spouses Social Security Number. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Write your Social Security number on the check or money order. INtax only remains available to file and pay the following tax obligations until July 8 2022. You must include Schedules 1 add-backs 2 deductions 5 credits such as Indiana withholding 6 offset credits and IN-DEP dependent information if you have entries on those.

However if an entity pays or credits amounts to its nonresi-dent shareholders partners or beneficiaries one time each year the. Take the renters deduction. Pay the amount due on or before the installment due date.

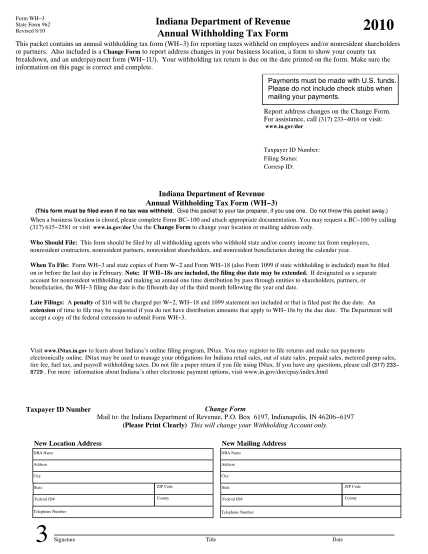

Economic Development for a Growing Economy Credit. We last updated Indiana Form ES-40 in January 2022 from the Indiana Department of Revenue. Indiana Department of Revenue PO.

Estimated Tax Payment Voucher. We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government. Entitys Composite Adjusted Gross Income Tax Return.

Overseeing and disbursing county city town and school tax distributions. Enclose your check or money order made payable to the Indiana Department of Revenue. Indiana Fiduciary Income Tax Return.

Pay the amount due on or before the installment due date. Estimated payments may also be made online through Indianas INTIME website. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Have more time to file my taxes and I think I will owe the Department. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you expect to receive a refund there is nothing to mail and the PFC will not print This form must accompany any payment you make to the Indiana Department of Revenue.

Please check the appropriate box on the front of this form to let us know if you are making an estimated extension or composite payment. If you owe Indiana state taxes a post filing coupon PFC will print with your return. You can find your amount due and pay online using the intimedoringov electronic payment system.

Income Tax Returns With Payment Indiana Department of Revenue PO. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check. 2021 Estimated Tax Payment Voucher.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Economic Development for a Growing Economy Retention Credit. Indiana payment vouchers No you are not required to pay the estimated tax vouchers for 2017 which were generated to assist with tax planning and avoiding tax penalties for the current year.

You must include Schedules 1 add-backs 2 deductions 5 credits such as Indiana withholding 6 offset credits and IN-DEP dependent information if you have entries on those schedules. When filing you must include Schedules 3 7 and CT-40 along with Form IT-40. 15 2022 4th Installment payment due Jan.

Since the change in your tax situation is not expected to repeat during the current year the estimated tax payments would not apply they are not a requirement just a. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Box 7224 Indianapolis IN 46207-7224 Income Tax Returns Without Payment Indiana Department of Revenue PO.

The Auditor of State is the chief financial officer of the state of Indiana and has four primary duties. More about the Indiana Form ES-40 Estimated. To pay go to wwwingovdor4340htm and follow the step-by-step instruc- tions.

Pay my tax bill in installments. Indiana - Printing the Post Filing Coupon PFC Payment Voucher. Enclose your check or money order made payable to the Indiana Department of Revenue.

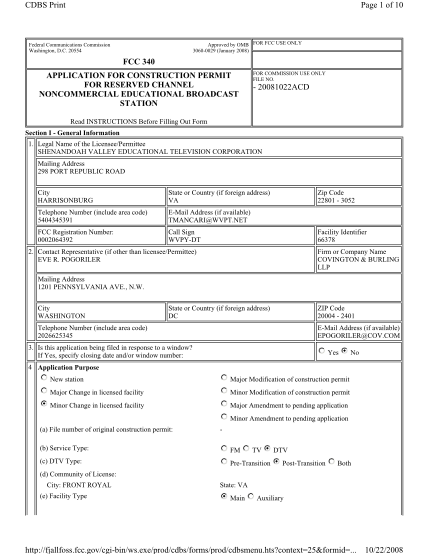

Indiana Earned Income Credit Publication. Form IT-41ES Indiana Department of Revenue Fiduciary Payment Voucher Estimated Tax Extension or Composite Payment State Form 50217 R11 8-21 For the calendar year or fiscal year beginning and ending Federal Employer Identification Number of Trust or Estate Name of Trust or Estate Name and Title of Fiduciary Trustee Executor Personal Representative. 23 rows Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year.

Find Indiana tax forms. All payments must be made with US. The fee for using this service is 1 They also list a credit card option but nothing I see uses a voucher.

Fiduciary representatives may use the IT-41ES Fiduciary Payment Voucher to make a payment for a trust or an estate. And paying the states employees. 17 2023 Mail entire form and payment to.

IT-41 Schedule IN K-1. To pay by credit card you may make your estimated tax payment online. Payment is generally due within 30 days following the end of the tax year or quarter if the liability for a quarterly period exceeds 150.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Indiana estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Estimated Payments Indiana does not require trusts and estates to make estimated payments.

Fill in the form save the file print and mail to the Indiana Department of Revenue. 1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. You will receive a confirmation number and should keep this with your tax filling records.

Accounting for all of the states funds. Nated Form WH-1 Indiana Withholding Tax Voucher. Paying the states bills.

Indianas Earned Income Credit. Indiana payment vouchers No you are not required to pay the estimated tax vouchers for 2017 which were generated to assist with tax planning and avoiding tax penalties for the current year.

Indiana Estimated Tax Payments 2021 Fill Online Printable Fillable Blank Pdffiller

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

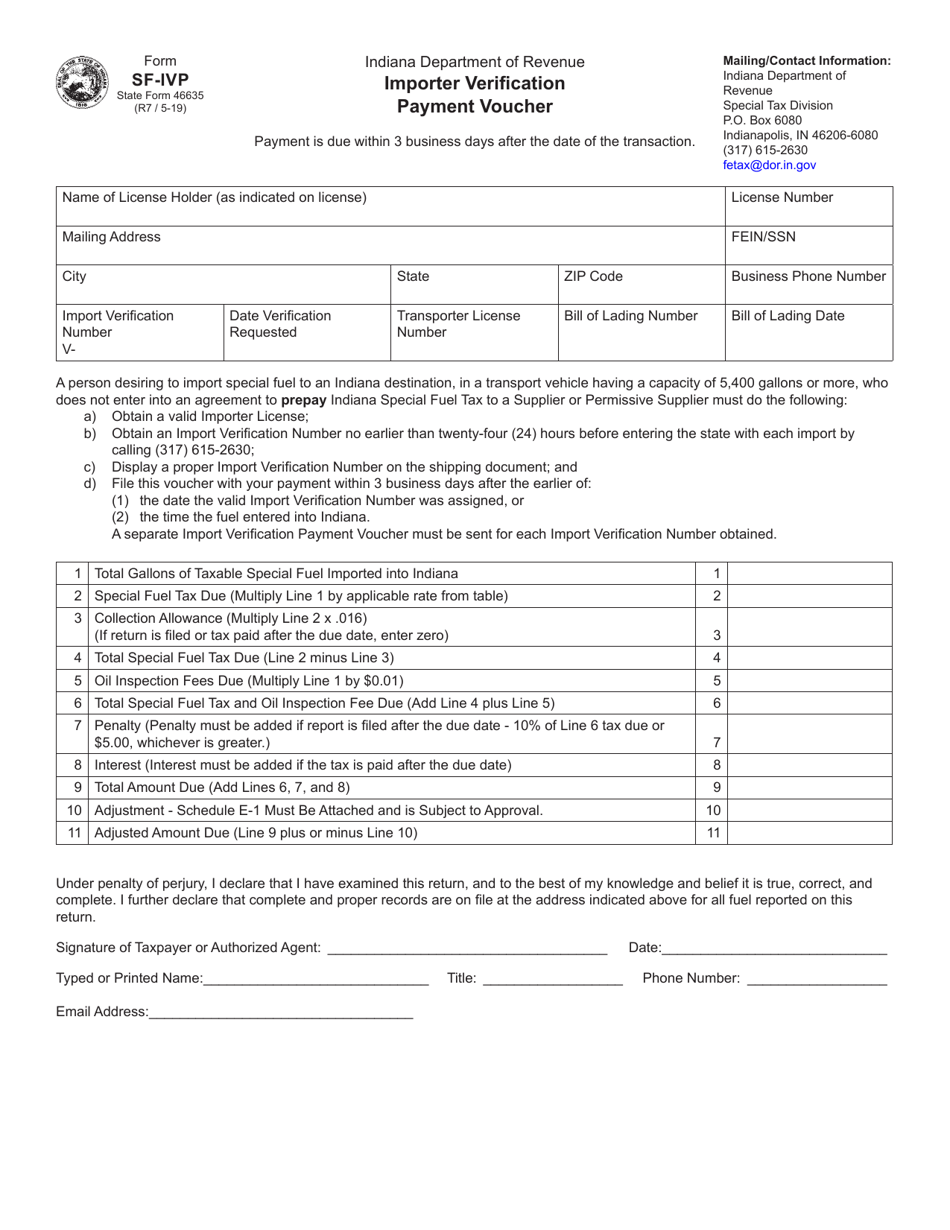

Form Sf Ivp State Form 46635 Download Fillable Pdf Or Fill Online Important Verification Payment Voucher Indiana Templateroller

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Nebraska Tax Forms And Instructions For 2021 Form 1040n

Tax Forms At The Library New Castle Henry County Public Library

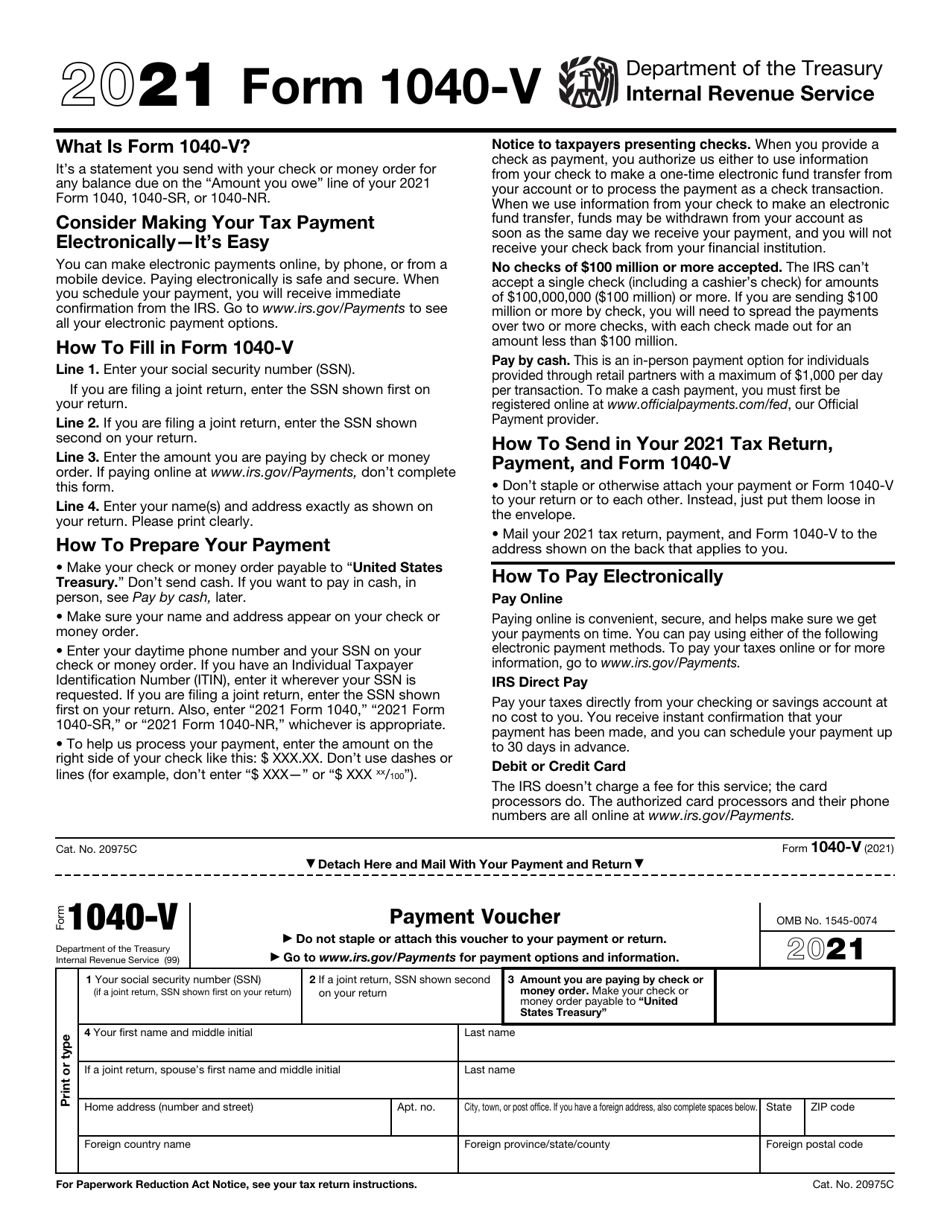

Irs Form 1040 V Download Fillable Pdf Or Fill Online Payment Voucher 2021 Templateroller

Indiana Form It 6 Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller